Total resources are now 1,400 Mt1 at 12% TiO? and 4,000 ppm TREO, the company said.

Company is preparing for a busy year of exploration at its Oval nickel-copper project following a high-grade discovery last year.

Miner said the successful start of underground production stoping from the Mt Mann orebody is a "key milestone".

Silver is currently trading at $30.25 per ounce.

Alphamin said the insurgents have now withdrawn eastward, and the company will initiate a phased resumption of operations.

Upcoming feasibility study envisions a project footprint of less than 1 sq. km where water use is minimized and tailings are deposited underground.

"Ultimately gold continues to be seen as a hedge against instability here," an analyst said.

Copper CEO Katie Jackson said rising US interest in the copper supply chain may lead to approval for the stalled mine.

Petra Diamonds has earned $103 million from 2025 sales so far, down from $138 million in the same period last year.

US president also instructed the Interior Department to locate coal deposits on federal lands, remove barriers to mining, and fast-track leasing processes.

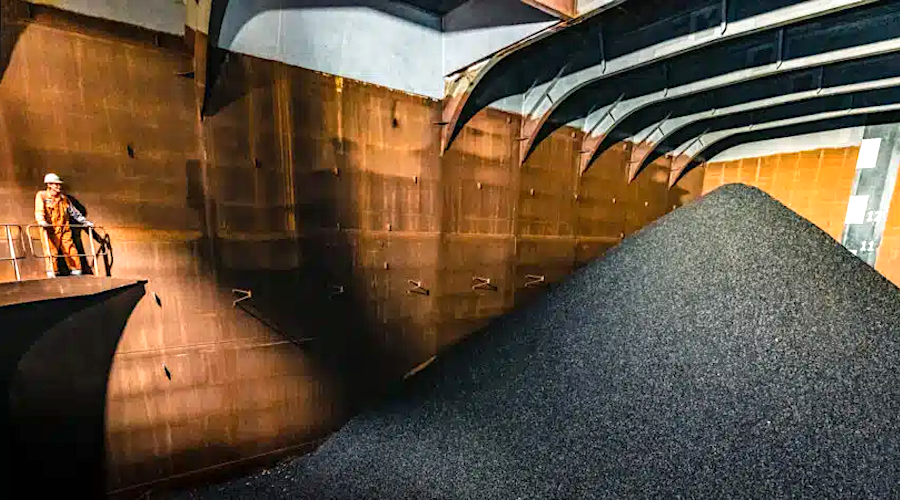

Leveraging a $10 billion investment to build the mine in Saskatchewan, BHP is targeting 4.3 million tonnes of production by next year.

The company – which operates mines in Turkey, Greece and Canada – forecasts production to hit between 660,000 and 720,000 oz. gold by 2027.

If gold were to be excluded, then underlying data shows that Switzerland's trade surplus with the US would appear smaller, according to SNB analyst.

Reko Diq is considered one of the largest undeveloped copper-gold deposits in the world.

Copper prices fell for a third straight day, translating to a 20% decline from their recent high in late March.

The Australian miner said it would now take a phased development approach to the project instead of a full-scale development until market conditions improve.

The Parbec project is located on the Cadillac Break, arguably one of Canada's deepest and most productive gold structures.

Uranium may run out in 60 years if nuclear energy demand increases, the Nuclear Energy Agency and the International Atomic Energy Agency say.

The Texas-based lithium extraction facility is said to be able to meet entire national demand for battery-grade lithium carbonate by 2029.

Eminent Gold currently has three gold exploration projects in Nevada.

New processes are to help the island nation develop its gold, coal and rare earth minerals while respecting Indigenous rights, says resources minister.

The figure underlines the gap between mining productivity and the rising needs driven by energy transition and supply chain pressures.

Kazakhstan is counting on its estimated $40 trillion mineral wealth to spark a mining boom.

Kamoa's copper production came near a record high at 133,120 tonnes in Q1 2025.

There is a growing chorus of voices championing increased exploration and resource discovery in the global scramble to secure critical minerals.

The Canadian province generates over C$15 billion worth of minerals per year.

Gold has retreated below $3,000, but remains one of the top-performing commodities in 2025.

The transaction quadruples Wesdome’s land position at the Eagle River gold operation in Ontario.

The deal consolidates New Gold’s ownership of the New Afton copper-gold mine in Canada's British Columbia.

Germany has some 1,200 tonnes or about a third of its gold stored in the vaults of the New York Federal Reserve in Manhattan.

US Army Research Laboratory developed nanostructured copper alloy with exceptional thermal stability and mechanical strength.

The company is also considering changing its name from Barrick Gold to Barrick Mining to reflect its changing production profile, chairman John Thornton said.

Scandium can be combined with aluminum to produce an alloy that’s as strong as steel and titanium while weighing around one-third of steel.

Last month, the government promised to extend the mineral exploration tax credit for another two years.

A plunge in the copper price on Friday turned the mining sector into one of the worst performers amid a broad market selloff.

US tariffs, falling prices, and shifting demand are dragging down the battery raw materials market, Fastmarkets says.

Still, gold stands to benefit further from an increasingly volatile macroeconomic and geopolitical environment, according to banks and analysts.

Mexico’s image as a tough place for mining may show little sign of abating under the Claudia Sheinbaum administration.

Path to full-scale production has been slowed by delays in transferring the mining licence to a JV with Mali's government.

One factor behind the undervaluation of gold mining stocks today is the inflation pressure from last year, says the gold bull.

Company to start drilling up to 10,000 metres in the Cadillac Break of Quebec’s Abitibi region after securing an option on the Bousquet gold project

It plans to advance drill-ready projects while managing data and quality control in-house to speed up decision-making across its portfolio.

The US Geological Survey currently lists 50 different minerals that it considers to be critical.

The tariffs include a universal 10% levy on imports and targeted measures on 60 countries, marking a major shift in trade policy.

The funding will support the commercialization of LithX, a novel lixiviant chemistry designed to improve the recovery of copper at reduced costs.

Most major copper producers also saw significant losses in the stock market.

The new bid values Sierra Metals at C$235 million.

Traders attributed gold's dip to profit-taking and investors selling some of their bullion holdings to cover losses in other asset classes.

So far, 11 companies have applied under Milei's Regime for Large Investments.

The Australian lithium explorer dismissed the bid as "opportunistic" and "undervalued," claiming it doesn't reflect its assets' potential.

Tanbreez represents one of the largest untapped heavy rare earths deposits outside China.

The contract will run through December 2028 and is expected to generate over $60 million in annual revenue.

The company made on-spec neodymium-praseodymium in less than a week at its White Mesa uranium mill.

BHP is currently the third-largest producer of iron ore and a major producer of met coal.

A feasibility study is underway to increase the How gold mine's output from last year’s 27,000 oz. total.

Production for 2026 is expected to reach 155,000 oz., the company said.

The sale marks Appian's 13th successful exit after building up mining assets.

The German state of Saxony says the lithium project is a high-priority initiative to en Europe’s dependence on foreign raw materials.

Drew Horn talks about aligning private investments with federal policies and points at key gaps in the US supply chain.

Chilean copper giant Codelco will supply copper to Adani's Kutch smelter — the world’s largest — starting this year.

Power Metallic holds 46 sq. km of land at its Nisk project in northwestern Quebec.

Oroco Resource is preparing to release an updated economic assessment for the Santo Tomas copper project.

According to the IEA, global battery demand reached a historic milestone of 1 terawatt-hours last year, with annual electric car sales rising by 25% to 17 million.

The decision follows failed negotiations towards a land access agreement with the community of Carrizalillo.

The acquisition, says Endeavour CEO Dan Dickson, brings the company closer to becoming a senior silver producer.

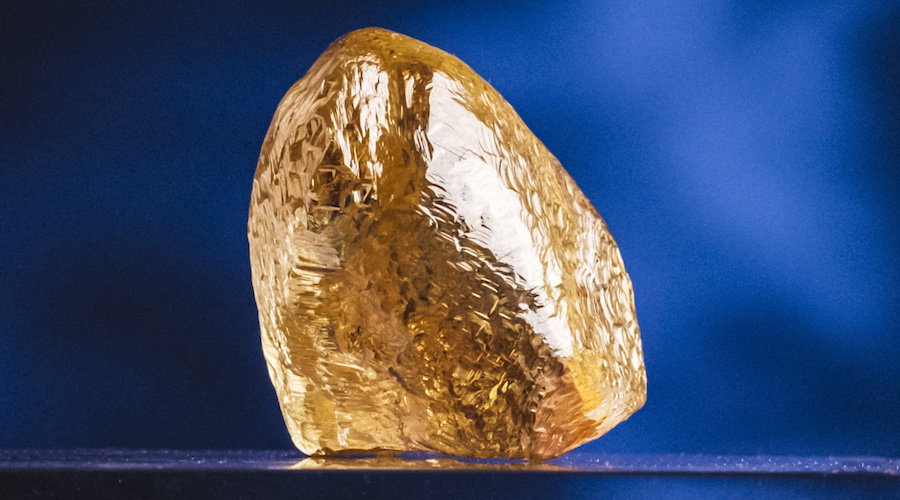

The 158.20-carat rock is one of only five yellow diamonds weighing more than 100 carats ever found at Diavik in its 22-year history.

The move would enable miners to bypass the ISA and obtain permits from the US National Oceanic and Atmospheric Administration.

China in February announced plans to impose export controls on five key metals — tungsten, tellurium, molybdenum, indium and bismuth — in response to US President Trump’s import tariffs.

Under new reporting standards that took effect in January, companies are now required to confirm their sustainability and risk data.

A partnership between the software companies is seeking to help miners shift from manual processes to real-time financial reporting and automated cost tracking.

The PEA demonstrates an internal rate of return of approximately 180%.

Lipari holds one project in Angola and one producing mine in Brazil.