UK flags possible security review as deep-sea mining licences go up for sale: FT

Posted Under Commodity News, On 22-04-2025

Source: mining.com

Britain may trigger a national security review over the proposed sale of two deep-sea mining exploration licences after the Norwegian parent of UK Seabed Resources (UKSR) filed for bankruptcy, the Financial Times reported.

The licences, sponsored by the UK and located in the Pacific Ocean, are held by UKSR, which was acquired in 2023 by Norway’s Loke Marine Minerals from US defense contractor Lockheed Martin. Loke filed for bankruptcy earlier this month, prompting an auction for its assets.

The Department for Business and Trade said the transfer of these licences could be assessed under the National Security Investment Act, according to an email sent to Loke’s CEO Walter Sognnes and reviewed by FT. The government official also suggested restructuring UKSR under a UK holding company to avoid scrutiny, stating that having Norwegian parent company would be “problematic”, the FT report said.

The Act grants the British government authority to examine and intervene in transactions deemed a threat to national security. The department declined to comment when contacted by FT.

The potential sale comes amid heightened global interest in critical minerals used in batteries, such as nickel, cobalt and copper, which are found on the ocean floor. US President Donald Trump recently voiced support for accelerating deep-sea mining, adding pressure on allies to secure mineral supply chains.

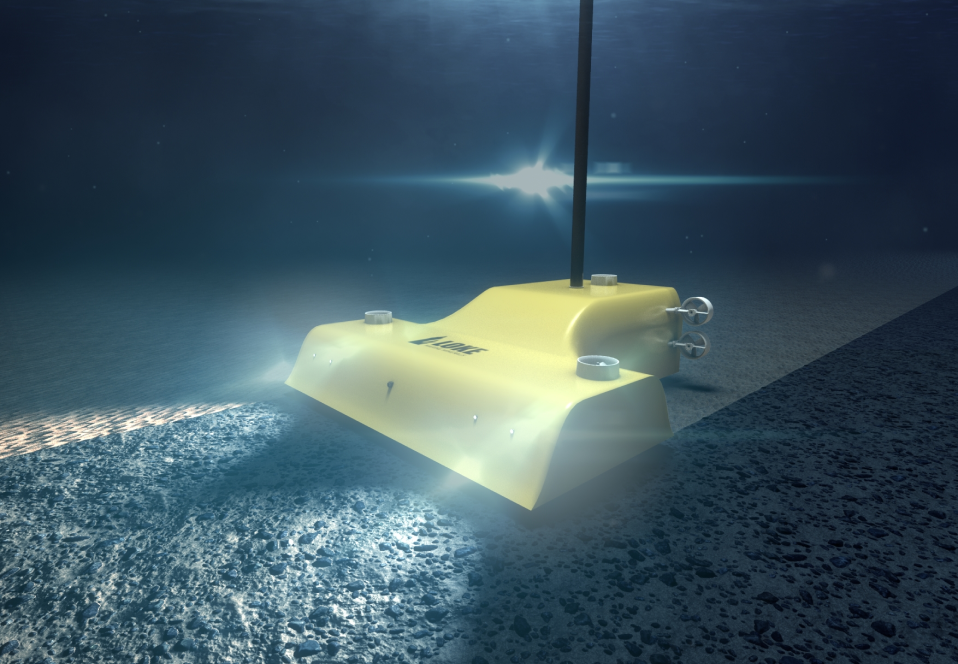

Loke, which had been developing seabed mapping technology, said any ownership structure would be discussed by the future owner and UK authorities.

Seabed mining permits in international waters require state sponsorship under the UN Convention on the Law of the Sea. China currently leads in the number of such licences. Norway plans to begin commercial deep-sea mining in its national waters, while the UK, France and Germany remain cautious over environmental concerns.

The Jamaica-based International Seabed Authority (ISA) previously warned Loke that UKSR risked non-compliance with exploration terms. The company has also reportedly fallen behind on licence payments.

Sources close to Loke said the company struggled to raise capital, blaming regulatory uncertainty and delays by ISA member states. “No international regulation has taken longer to get into place than this one,” one source told FT.

Among the bidders for UKSR’s licences was environmental group Greenpeace, which entered the auction as a mere stunt to protest the commercialization of deep-sea mining. Other bidders include Loke’s founders and UK-based TechnipFMC, one of its investors.

Duncan Currie, legal adviser to the Deep Sea Conservation Coalition, criticized foreign control of licence-holding firms, stating that it undermines the legal framework that governs seabed access.